Financial Intelligence

Reconstruct complete context across proprietary research, deal histories, and market data so AI can execute investment workflows with institutional accuracy, traceability, and control.

What this breaks in the business

-

Distorted Financial Interpretation Disconnected context leads to incorrect ratio analysis and deal term summaries.

-

Missed Diligence Signals Historical red flags fail to surface when prior deal outcomes aren’t connected.

-

Extended Deal Cycles Manual cross-verification slows screening, diligence, and IC preparation.

-

Unverifiable AI Output Insights without traceable provenance cannot enter an institutional decision process.

Nand AI Approach

Reconstructing the Financial Digital Thread

Nand AI doesn’t retrieve information. It reconstructs meaning.

Nand AI doesn’t summarize data. It reconstructs institutional memory.

Our Context Engine builds a graph-first intelligence layer that becomes the system of record for your firm’s collective decision-making.

- Links past deals to outcomes and market conditions

- Connects valuation models to internal revisions and assumptions

- Maps analyst commentary to final investment decisions

- Traces compliance and risk logic across time and teams

This is the financial digital thread rebuilt as living context.

What this enables

Institutional Thesis Intelligence

Traverse historical deals, failures, and successes to identify market-fit patterns beyond surface-level metrics.

Timeline & Version Awareness

Track how valuations, risk assessments, and assumptions evolve so agents always reason from approved context.

Decision Provenance & Trust

Every insight is grounded in an identifiable analyst, document, and timestamp.

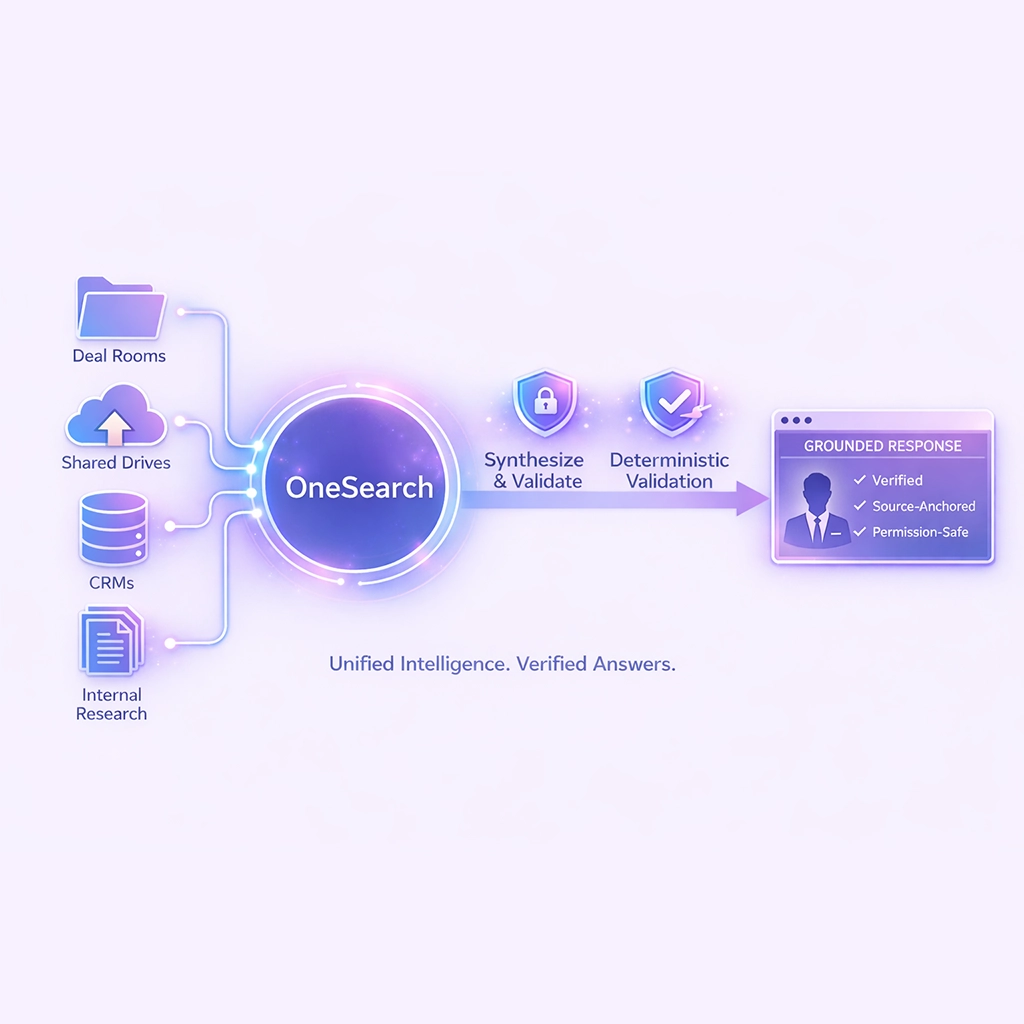

OneSearch for Investment Teams

OneSearch gives associates, principals, and partners a unified intelligence layer over internal research, deals, and firm knowledge. It doesn’t return links. It synthesizes answers.

KEY CAPABILITIES

- Synthesize Answers Across Systems

Pull context from deal rooms, shared drives, CRMs, and internal research into a single grounded response. - Permission-Aware by Design

If a user doesn’t have access to a fund, deal, or memo, the data never surfaces. - Deterministic Validation

Claims without a traceable source or deterministic anchor are rejected before delivery. Hallucinations never reach the user.

Commercial to Operational

Agentic Workflows in Action

The power of an agent is only as good as its data. By using Nand AI as your central Context Engine, you can deploy agents that execute high-stakes, multi-step workflows.

Agent 1

Market-Fit Analyst Agent

Automates early-stage investment screening without compromising thesis discipline.

- Cross-references new deal flow against historical success and failure archives

- Flags deviations from core investment criteria

- Surfaces contextual comparisons across markets and timeframes

Primary outcome: Faster screening. Higher conviction deal focus.

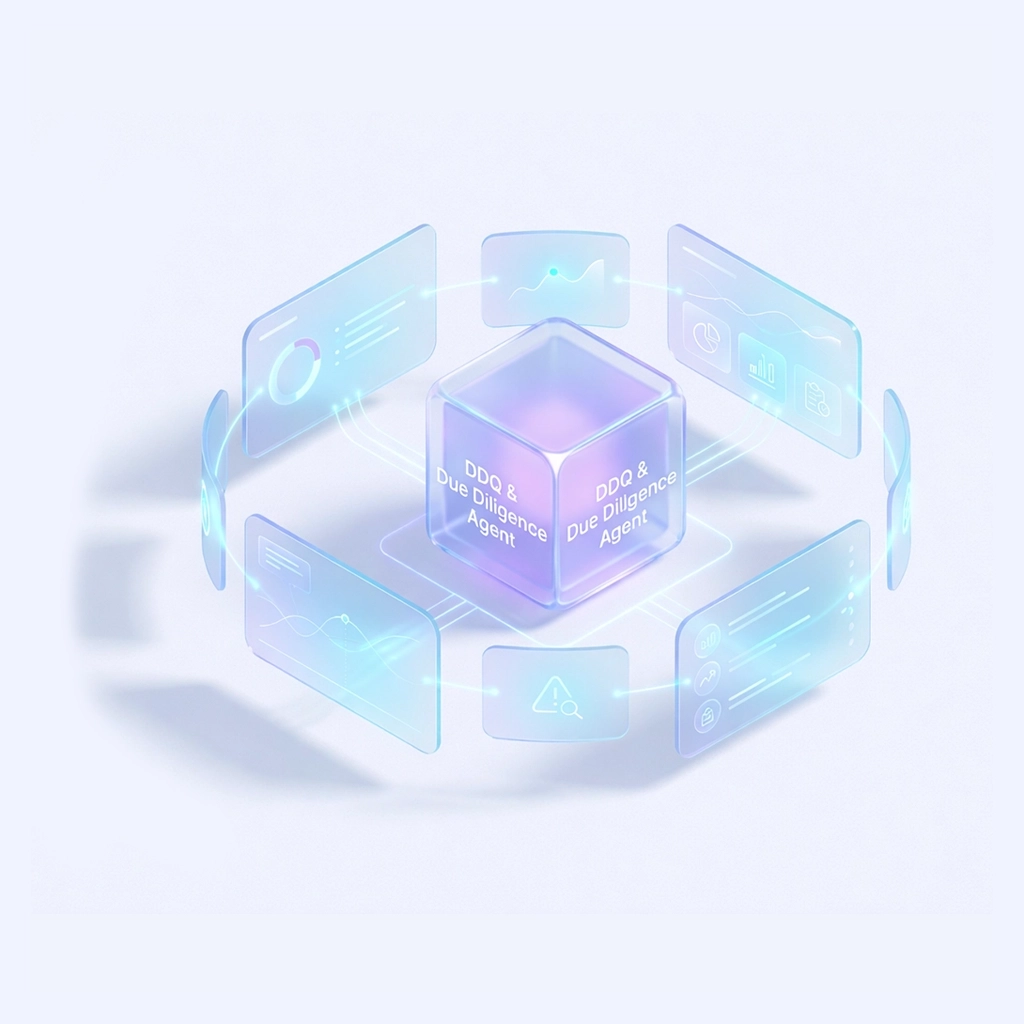

Agent 2

DDQ & Due Diligence Agent

Accelerates diligence while improving risk detection.

- Parses DDQs, data rooms, and disclosures

- Flags red risks based on historical deal outcomes

- Grounds findings in firm-specific diligence logic

Primary outcome: Shorter diligence cycles. Earlier risk visibility.

Agent 3

Portfolio Compliance Agent

Monitors internal communications for governance risk with contextual understanding.

- Tracks MNPI references across Slack and email

- Maps activity to internal compliance policies

- Preserves audit trails and evidence

Primary outcome: Continuous compliance. Lower regulatory exposure.

Agent 4

Investment Research Assistant Agent

Supports deep research without manual synthesis.

- Connects analyst notes, market research, and internal commentary

- Produces grounded summaries with full provenance

- Adapts output based on user role and permissions

Primary outcome: Faster research. Higher analytical confidence.

Agent 5

Internal Knowledge & Onboarding Agent

Preserves and scales institutional knowledge.

- Answers questions on internal processes, tools, and best practices

- Grounds responses in approved firm documentation

- Maintains version and authorship awareness

Primary outcome: Faster ramp-up. Less partner interruption.

Agent 6

Risk & Governance Intelligence Agent

Surfaces hidden exposure across investment activity.

- Connects deal activity to internal risk thresholds

- Flags inconsistencies across approvals and execution

- Provides traceable explanations for every alert

Primary outcome: Fewer surprises. Stronger governance control.

Executing with Complete Context

Nand AI is the architecture that scales financial intelligence across time horizons.

IMMEDIATE IMPACT

Accelerate investment screening

Automate thesis alignment and early diligence without analyst bottlenecks.

Target Outcome

50% Faster Deal Evaluation

THIS QUARTER

Reduce diligence & compliance friction

Deploy agents that cross-reference every assumption, risk, and policy automatically.

Target Outcome

Zero Unverified Claims

FUTURE STATE

Build an autonomous investment intelligence stack

Orchestrate research, diligence, compliance, and knowledge preservation as a unified system.

Target Outcome

Context-Driven Investment Ops

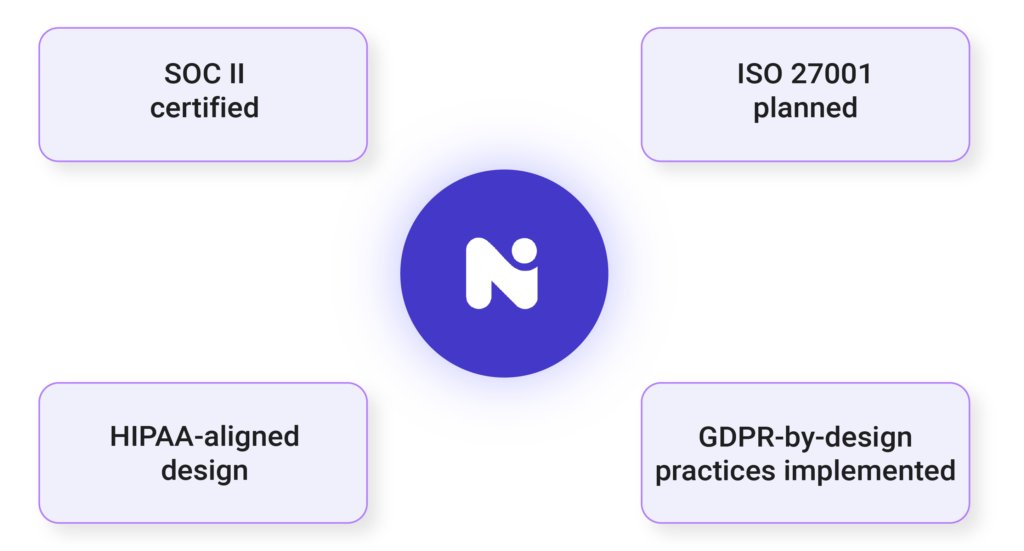

Security & Compliance

Enterprise Security by Design

Security is not an afterthought. Our platform is built for the most stringent regulatory environments, ensuring your data never leaves your perimeter and access is strictly audited.

-

Tenant-Isolated Architecture

-

Zero-Training Guarantee

-

(our models don't train on customer data)

Help Center

Frequently asked questions

Quick answers to questions you may have. Can't find what you're looking for? Reach us out

Magus is the execution layer powered by the Nand AI Context Engine. It securely connects to your trusted enterprise systems such as Google Drive, Salesforce, Slack, and ServiceNow, reconstructs full context across documents, authors, and timelines, and generates accurate, evidence-backed responses for workflows like RFPs, security questionnaires, and real-time sales support.

Magus is built for enterprise sales, pre-sales, proposal, legal, and procurement teams operating in complex, high-stakes environments. It is used by teams that require accurate, traceable answers across large and evolving knowledge bases. The Universal Search capability can be used across the organization to retrieve precise, context-aware answers.

Most customers are production-ready in hours, not weeks. Initial deployment is typically completed the same day, depending on the number of systems being connected.

General-purpose AI is designed for broad knowledge and open-ended conversation. It is not built for enterprise accuracy, governance, or traceability.

Magus is different in three critical ways:

- It operates only on your verified enterprise data

- Every answer is grounded with source citations

- Each response is confidence-scored to surface uncertainty

This makes Magus suitable for high-stakes enterprise workflows where correctness matters.

Accuracy is enforced through the Nand AI Context Engine and validation layer.

Every response is:

- derived from your verified source material

- checked against the knowledge graph for consistency

- rejected if it cannot be traced to a specific source or timestamp

This eliminates black-box behavior and ensures outputs are auditable.

Security is foundational to the Nand AI platform.

- All data is encrypted in transit and at rest

- Customer data is tenant-isolated

- Your data is never used to train third-party models

- Full audit trails are maintained for all access and activity

Nand AI is built for enterprise-grade security and compliance from the ground up.

Magus integrates with the systems where your enterprise knowledge already lives, including:

Google Drive, Salesforce, ServiceNow, Microsoft Teams, HubSpot, OneDrive, Jira, Zendesk, Slack, Notion, Confluence, and custom enterprise systems.

New connectors can be added without disrupting existing workflows.

Ready to fix your industrial context challenge?

The next generation of industrial AI won’t be built on prompts and patches.